san francisco gross receipts tax estimated payments

There are two components to the tax and estimated payment a payroll tax expense and a gross receipts tax. Beginning of calendar year.

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing.

. You can file online with the City. You may pay online through this portal or you may print a stub and mail it with your payment. Due Dates for Quarterly Installment Payments.

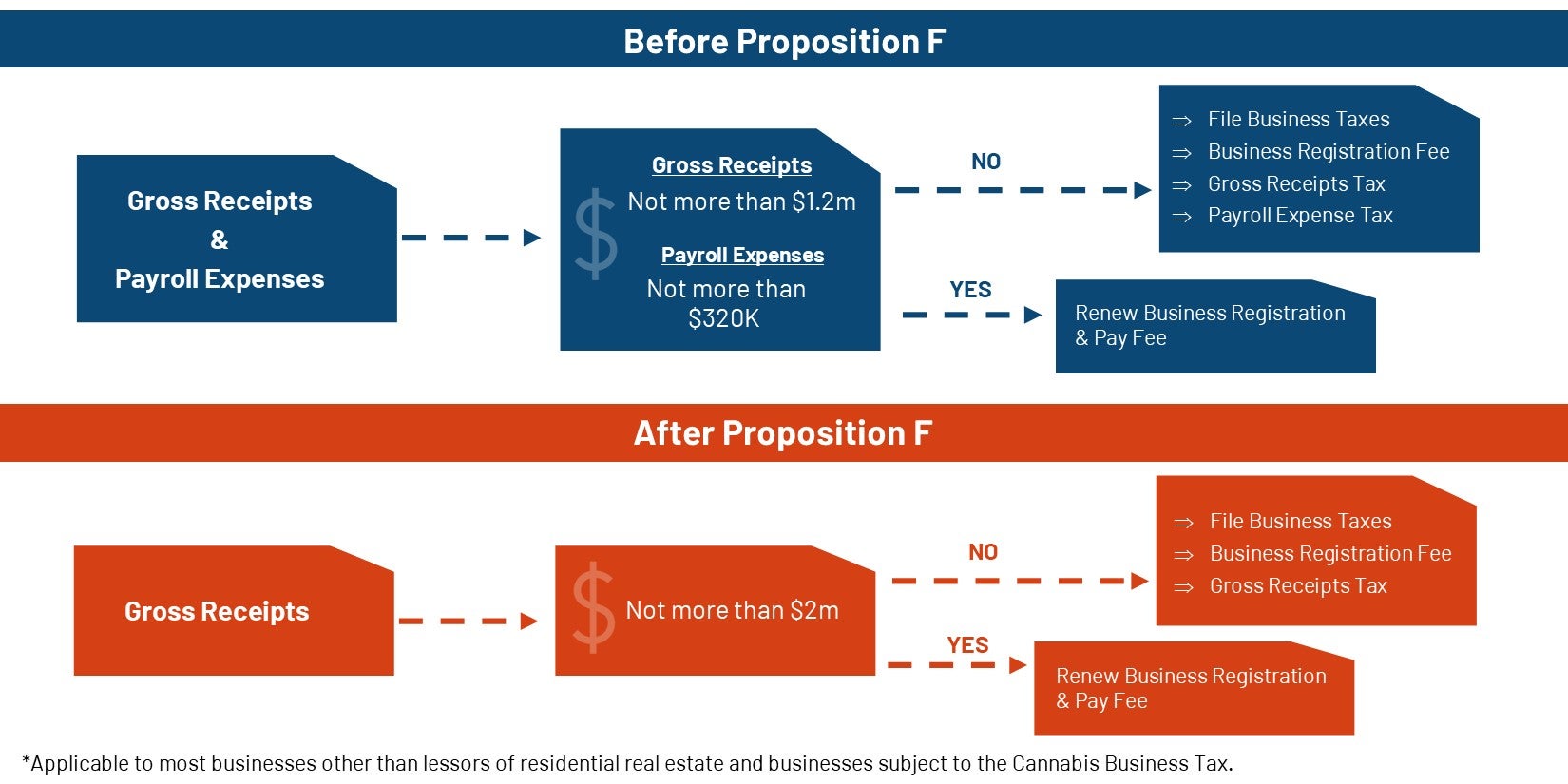

For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021. 5 The current Payroll Expense Tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the City in 2018. 6 The passage of Proposition F fully repeals the Citys Payroll Expense Tax.

Quarterly estimated tax payments of the san francisco local business taxes that would otherwise be due on april 30 2020 by taxpayers or combined groups with combined san francisco gross receipts in calendar year 2019 of over 10 million still need to make these payments on time. Quarterly estimated tax payments of the Gross. Final Payments for Q4 2014 The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28.

Retail and wholesale Code Sec 9531 Manufacturing transportation and warehousing information biotechnology clean technology and food services Code Sec 9532 Accommodations utilities arts entertainment and recreation Code Sec 9533. The effective date of this ordinance shall be ten days after the date the official vote count is declared by the Board of Supervisors. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the payment portal within 24 hours of completing your filing.

Business Tax Overhaul. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. The Citys support efforts include the deferral of business taxes and licensing fees as well as the launch of an economic relief fund.

Residential landlords that rent four or more units with annual gross receipts less than 1090000 and payroll expense less than 300000 are. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. Payroll Expense Tax and Gross Receipts Tax returns due.

First quarter 2016 estimated gross receipts tax installment Due May 2 2016. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively. San francisco gross receipts tax estimated payments Friday February 18 2022 Edit.

The other four. If approved you will have until may 6 2021 to pay your bill without incurring any late payment penalties However because the last day of. An EDD representative may call employers as well as claimants to resolve eligibility issues.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. That includes a new director or architect of gross receipts who will make 246400 a year. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

On March 11 2020 the City of San Francisco announced measures to support small businesses in light of the COVID-19 outbreak. Quarterly estimated tax payments of weird Gross Receipts Tax Payroll. Estimated business tax payments are due April 30th July 31st and.

If you operate a business in San Francisco the deadline for filing and paying the second installment of your 2014 estimated Payroll and Gross Receipts tax is due on July 31 2014. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space in San Francisco and 3.

The tax collector is asking for five new employees at a total annual cost of 836371. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069 on gross receipts over 50 million that a business receives in San Francisco and another tax of 15 on certain administrative offices payroll expense in San Francisco.

For tax year 2017 the gross receipts tax rates range from 005625 to 04875. Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health Fire Department. Estimated business tax payments are due april 30th july 31st and october 31st.

The current due date for the city of san francisco payroll expense tax and gross receipts tax statement is february 28. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax payments and file an annual tax return. Deferral of Quarterly Business Taxes Due April 30 2020.

Updated minimum wage rate for the upcoming year published by the SF Office of Labor Standards and Enforcement. Estimated tax payments due dates include April 30th August 2nd and November 1st. What if i need to tax quarterly wage correction.

Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. This tax adds to san franciscos broader gross receipts tax which applies rates ranging from 016 percent to 065 percent for firms with more than 1 million in gross receipts.

San Francisco Gross Receipts Tax Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation. 25m Retail Trade.

The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned. Businesses operating in San Francisco pay business taxes primarily based on gross receipts. Business registration renewal for the period July 1 2016 through June 30 2017 Due May 31 2016.

Here are the 20162017 fiscal year San Francisco tax deadlines by quarter annually and for the annual registration renewal. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Quarterly Tax Calculator Calculate Estimated Taxes

San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Everything You Need To Know About Restaurant Taxes

San Francisco Taxes Filings Due February 28 2022 Pwc

Understanding California S Sales Tax

What Is Gross Receipts Tax Overview States With Grt More

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

California Sales Tax Small Business Guide Truic

Secured Property Taxes Treasurer Tax Collector

Gross Receipts Tax And Payroll Expense Tax Sfgov

Irs Tax Refunds Delayed Why Are Refunds Taking So Long Marca

Due Dates For San Francisco Gross Receipts Tax

How Do State And Local Sales Taxes Work Tax Policy Center

How To Create A Customer Service Plan Edward Lowe Foundation How To Plan Small Business Start Up Accounting Services

Property Taxes Department Of Tax And Collections County Of Santa Clara